Smart invoicing has become the most sought-after method for following up on your orders along with taxation. Of course, it adds the burden of GST calculations and keeping track of records of all the incoming orders.

Basically, an invoice is a time-stamped business report that details and registers a transaction between a customer and a seller. If goods or services were to be obtained on credit, the description usually defines the terms of the transaction and presents data for the convenient means of payment.

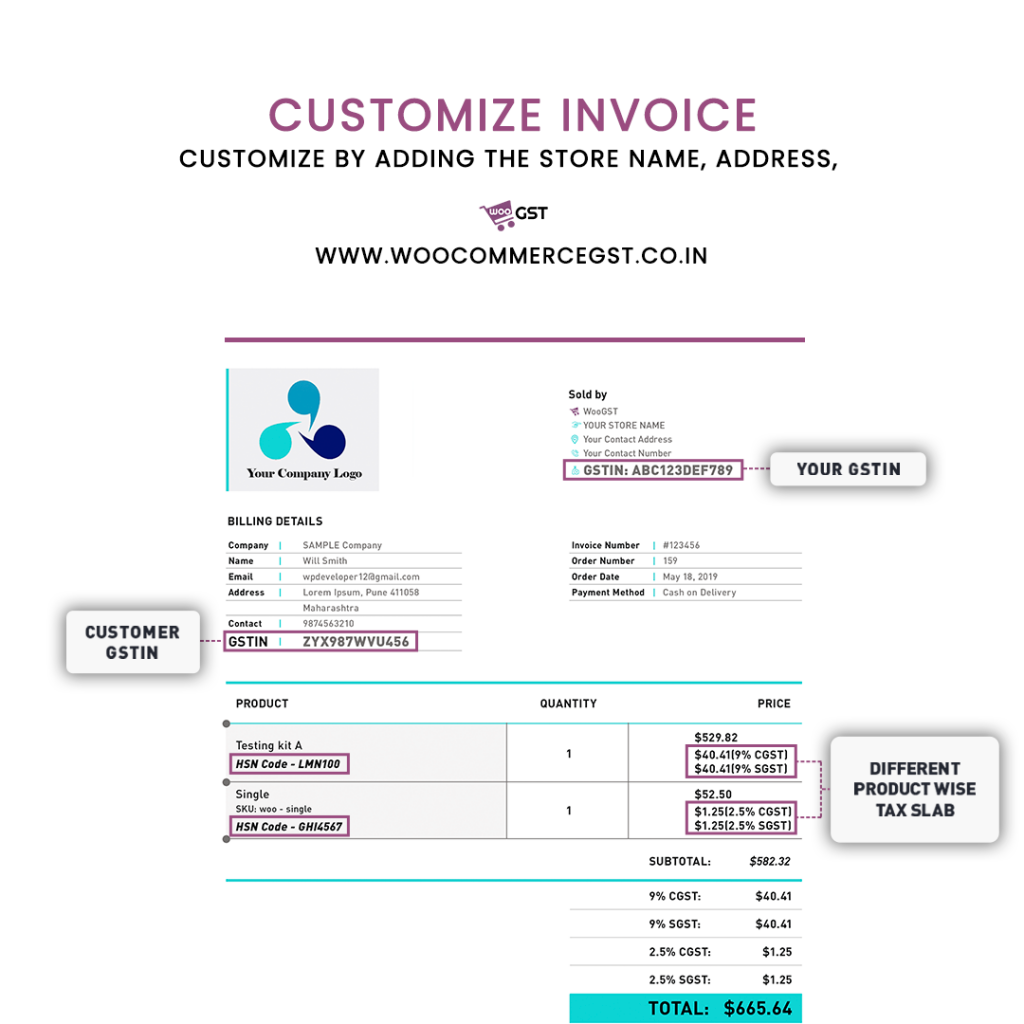

Now, preparing a detailed invoice can be a tedious task. But, WooCommerce GST will generate a full-fledged professional invoice for you in a matter of seconds. Plus the bonus is – automatic GST calculations! The only thing you need to do is add the accurate tax slab according to your requirement.

What to include in an invoice?

There are various pointers one can add to an invoice. Here’s a list of conventional ones.

-

Standout Header

This may seem very generic, but sometimes one needs to focus on the header as it will help you keep track of all your invoices.

-

Invoice Reference Number

Invoice Reference Number also known as IRN is a unique number assigned by Government to track and recognize each valid Smart Invoice formed in India. The IRN was implemented on 1st October 2020.

-

Invoice Date

A date is used as a time-stamp on an invoice and is issued for goods, which is usually sent on the same day the goods are sent to the buyer. The actual payment may or may not be due for a certain number of days after the invoice date.

-

Business Logo

A logo adds a professional look to your overall invoice and gives customers a vibe of trust when making payments. With WooCommerce GST Plugin you can do just that, you can add your company logo immediately to every invoice.

-

Business Contact Information

It’s quite necessary to add your basic contact information; this allows your customers to stay in touch with you. Hence don’t forget to add in your mail, address, contact number or any other details.

-

Products / Services Rendered

Always make it a point to add in a brief description regarding your product or services. This gives the customer a quick glance at what exactly they have purchased and helps you keep track of sold products.

-

Price / Quantity

Adding in the price and quantity is the basic; hence you will always find this on all the invoices.

-

HSN Number

Harmonized System of Nomenclature also known as HSN code is a 6-digit uniform code that arranges 5000+ items and is acknowledged around the world.WooCommerce GST is the only GST calculator that provides a Meta field for ‘HSN Code’.

-

Applicable Taxes Or Discounts: GST (SGST, CGST, IGST)

The invoice always has slots for taxes, discounts, and any other additional charges. Make use of this space and create a detail-oriented document.

-

Total Due And Due Date

To add in another section, you can follow it up by the total due and the due date. This will help you keep a record of all the debts and due dates.

-

Notes, Comments And Payment Terms

This one totally depends upon your business rules and regulations. But make use of this space as it helps the customer understand your company policy better.

-

Add A Unique Message

Make it customizable and genuine, this is where you start building bonds with your customers.

Note: Select a practical invoice numbering system; it will help you to record all your invoices properly.

Many times as a business owner, you might feel that the presentation of an invoice won’t matter as much. But in reality, it actually helps you maintain a lasting impression on your clients.

The principal importance of an invoice is to present a company and its customer with a report of the sale. It follows a particular direction in company accounting: invoices exhibit a client’s responsibility to pay you for your services.

To sum up – it’s crucial to understand how invoices can benefit a business in numerous ways in accordance with a client. First and foremost establish a clear connection with your client. Start by including project specifics, late payment terms, asking for deposits, and sending the invoice online.

Be prompt with the deliverance of your invoice, to speed up the process use retainer contracts with recurring billing.

For faster results, use smart invoicing software, you can get a GST invoice by opting for our WooCommerce GST Plugin. You will be provided with IGST calculated invoices as well, provided you are using the GST Plugin for WooCommerce. This will help you with invoicing international clients and building strong relations over time.

All Rights Reserved. © 2023